Follow Us

Join our newsletter

We will get back to you as soon as possible

Please try again later

By Carmen Ang Graphics/Design: Miranda Smith | Clayton Wadsworth

Explainer: What Key Factors Influence Gas Prices?

Across the United States, the cost of gas has been a hot topic of conversation lately, as prices reach record-breaking highs.

The national average now sits at $5.00 per gallon, and by the end of summer, this figure could grow to $6 per gallon, according to estimates by JPMorgan.

But before we can have an understanding of what’s happening at the pump, it’s important to first know what key factors dictate the price of gas.

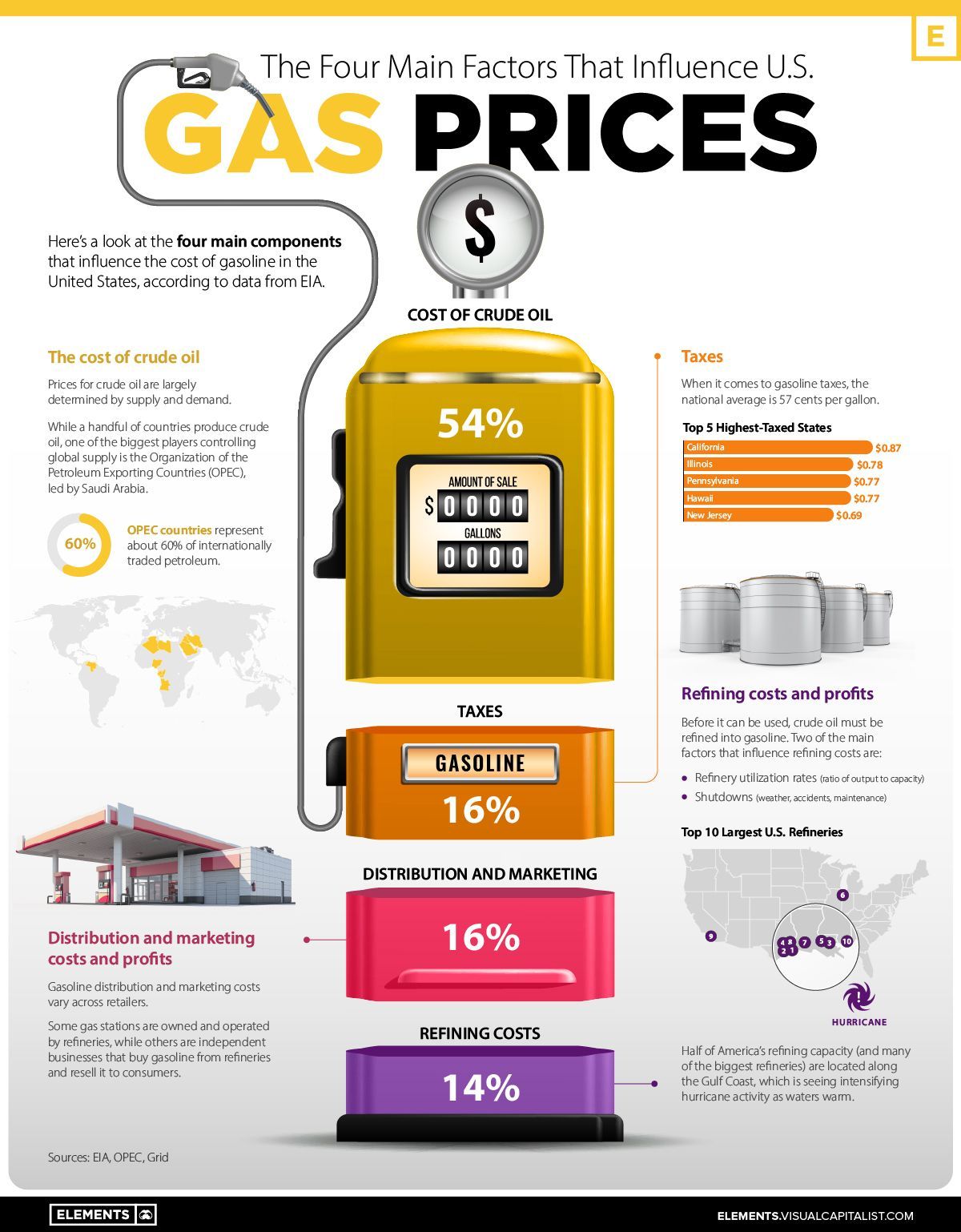

This graphic, using data from the U.S. Energy Information Administration (EIA), outlines the main components that influence gas prices, providing each factor’s proportional impact on price.

The Four Main Factors

According to the EIA, there are four main factors that influence the price of gas:

- Crude oil prices (54%)

- Refining costs (14%)

- Taxes (16%)

- Distribution, and marketing costs (16%)

More than half the cost of filling your tank is influenced by the price of crude oil. Meanwhile, the rest of the price at the pump is split fairly equally between refining costs, marketing and distribution, and taxes.

Let’s look at each factor in more depth.

Crude Oil Prices

The most influential factor is the cost of crude oil, which is largely dictated by international supply and demand.

Despite being the world’s largest oil producer, the U.S. remains a net importer of crude oil, with the majority coming from Canada, Mexico, and Saudi Arabia. Because of America’s reliance on imports, U.S. gas prices are largely influenced by the global crude oil market.

A number of geopolitical factors can influence the crude oil market, but one of the biggest influences is the Organization of the Petroleum Exporting Countries (OPEC), led by Saudi Arabia.

Established in 1960, OPEC was created to combat U.S. dominance of the global oil market. OPEC sets production targets for its 13 member countries, and historically, oil prices have been linked to changes in OPEC production. Today, OPEC countries are responsible for about 60% of internationally traded petroleum.

Refining Costs

Oil needs to be refined into gasoline before it can be used by consumers, which is why refining costs are factored into the price of gas.

The U.S. has hundreds of refineries across the country. The country’s largest refinery, owned by the Saudi Arabian company Saudi Aramco, processes around 607,000 barrels of oil per day.

The exact cost of refining varies, depending on a number of factors such as the type of crude oil used, the processing technology available at the refinery, and the gasoline requirements in specific parts of the country.

In general, refining capacity in the U.S. has not been keeping up with oil demand. Several refineries shut down throughout the pandemic, but even before COVID-19, refining capacity in the U.S. was lagging behind demand. Incredibly, there haven’t been any brand-new refining facilities built in the country since 1977.

Taxes

In the U.S., taxes also play a critical role in determining the price of gas.

Across America, the average gasoline tax is $0.57 per gallon, however, the exact amount fluctuates from state to state. Here’s a look at the top five states with the highest gas taxes:

| Rank | State | Gas tax (per gallon) |

|---|---|---|

| 1 | California | $0.87 |

| 2 | Illinois | $0.78 |

| 3 | Pennsylvania | $0.77 |

| 4 | Hawaii | $0.77 |

| 5 | New Jersey | $0.69 |

*Note: figures include both state and federal tax

States with high gas taxes usually spend the extra money on improvements to their infrastructure or local transportation. For instance, Illinois doubled its gas taxes in 2019 as part of a $45 billion infrastructure plan.

California, the state with the highest tax on gas, is expecting to see a rate increase this July, which will drive gas prices up by around three cents per gallon.

Distribution and Marketing Costs

Lastly, the costs of distribution and marketing have an impact on the price of gas.

Gasoline is typically shipped from refineries to local terminals via pipelines. From there, the gasoline is processed further to ensure it meets market requirements or local government standards.

Gas stations then distribute the final product to the consumer. The cost of running a gas station varies—some gas stations are owned and operated by brand-name refineries like Chevron, while others are smaller-scale operations owned by independent merchants.

The big-name brands run a lot of advertisements. According to Morning Consult, Chevron, BP PLC, Exxon Mobil Corp., and Royal Dutch Shell PLC aired TV advertisements in the U.S. more than 44,495 times between June 1, 2020, and Aug. 31, 2021.

How Does the Russia-Ukraine Conflict Impact U.S. Gas Prices?

If only a fraction of America’s oil comes from Russia, why is the Russia-Ukraine conflict impacting prices in the U.S.?

Because oil is bought and sold on a global commodities market. So, when countries imposed sanctions on Russian oil, that put a squeeze on global supply, which ultimately drove up prices.

This supply shock could keep prices high for a while unless the U.S. falls into a recession, which is a growing possibility based on how recent data is trending.

Copyright © 2024 Visual Capitalist

Contact

info@vvcresources.com

2369 Kingston Road, PO Box 28059 Terry Town, Scarborough, ON M1N 4E7 Canada

About

Projects

Sign up to receive updates on VVC announcements, launches, and opportunities.

Contact Us

Thank you for signing up!

You will receive VVC updates straight to your inbox.

Please try again later.